How to set up a company in Dubai Free Zone? Dubai’s free zones are attractive investment destinations for investors and businessmen from all over the world. These areas provide a favorable environment for establishing companies thanks to the distinctive incentives they offer, such as full tax exemptions, freedom to transfer profits, and full foreign ownership without the need for a local partner. Dubai’s free zones also provide access to advanced infrastructure and an extensive transportation network, facilitating the movement of goods and people. This article covers the basic steps for setting up a company in Dubai Free Zone , as well as the advantages and benefits that investors can reap from this option.

جدول المحتوى

ToggleSteps to establish a company in the Dubai Free Zone

Establishing a company in the Dubai Free Zone requires following a set of specific steps. Here are the basic steps:

- Determine the type of company and business activity: The investor must determine the type of company (such as a limited liability company or a branch of a company) and the business activity they will be engaged in.

- Choosing the right free zone: There are several free zones in Dubai, such as Dubai Metals Zone and Dubai Silicon Oasis. You should choose the zone that suits your business activity.

- Company Name Reservation: The investor must choose a trade name for the company that is in line with local laws, and then reserve it through the Department of Economic Development or the authority responsible for the selected free zone.

- Submitting the required documents: A set of documents must be submitted, such as passports, a lease contract for an office or workplace, and identity documents.

- Obtaining approvals: After submitting the application, the required approvals must be obtained from the authority responsible for the free zone.

- Signing the contract: After approval, the company’s incorporation contract is signed with the authority.

- Opening a bank account: The investor must open a bank account for the company in a local bank.

- Obtaining a commercial license: After completing all procedures, a commercial license can be obtained that allows the company to practice its activity legally.

- Employment Registration: If the company will employ employees, they must be registered according to local labor laws.

By following these steps, investors can establish successful companies in Dubai free zones and benefit from the many advantages they offer.

Free Zones in Dubai

Dubai’s free zones are among the world’s most prominent investment destinations, providing an ideal business environment that attracts investors from all over the world. These zones offer a variety of incentives, most notably tax exemptions that include no taxes on profits and income for long periods, which enhances the attractiveness of investment. Free zones also allow foreign investors full ownership of their companies without the need for a local partner, which is a unique feature in the region.

Free zones also offer a variety of business activities, with investors able to set up businesses in a variety of sectors including trade, technology, manufacturing, and logistics. Dubai offers a sophisticated infrastructure including modern ports and airports, facilitating the movement of goods and speeding up import and export processes.

Moreover, the UAE government enhances this investment environment by supporting new projects and providing advice to investors. The availability of business centers, equipped offices, and modern facilities makes it easier for startups to succeed and grow. In short, Dubai’s free zones are an ideal choice for investors seeking to establish their businesses in a dynamic and encouraging environment, contributing to the local and global economy.

How long does it take to establish a company in the Dubai Free Zone?

Establishing a company in the Dubai Free Zone usually requires 3 to 7 working days, depending on several factors, including:

- Company Type: Some types of companies may require additional procedures or special approvals, which may delay the incorporation process.

- Documentation availability: If the required documents are complete and accurate, it speeds up the approval and registration process.

- Selected Free Zone: Some free zones may have faster or more complex procedures than others.

- Additional Procedures: If there is a need to hire workers or obtain additional licenses, these procedures may increase the incorporation period. In general, it is preferable to plan ahead and ensure that all requirements are met to minimize any potential delays.

Advantages of establishing a company in the Dubai Free Zone

Establishing a company in the Dubai Free Zone offers many advantages that make it an attractive option for investors and businessmen. Here are some of the key features:

- Full Ownership: Setting up a company in a free zone allows you to own the company outright without the need for a local partner, giving you complete control over the business.

- Tax exemptions: Companies in the free zones enjoy tax exemptions that include no tax on income and profits for a period of up to 50 years, with the possibility of renewal.

- Ease of procedures: The process of establishing companies in free zones is easy and fast, as bureaucracy is greatly reduced, allowing you to start your business quickly.

- Business Facilities: Free zones provide a favourable business environment, including advanced infrastructure and excellent logistics services, facilitating the movement of goods and businesses.

- Freedom to transfer profits: You can transfer profits and revenues to your country without restrictions, which enhances the possibility of making and investing profits.

- Government Support: Free zones enjoy strong government support, which facilitates business and provides a safe and encouraging environment for investment.

- Diverse office options: Free zones offer multiple options for office locations, including virtual offices, helping startups reduce costs.

- International presence: Companies in free zones can help build a global network of business relationships, facilitating access to new markets.

These advantages make setting up a company in the Dubai Free Zone an ideal choice for investors seeking success in a dynamic business environment.

Documents required to establish a company in the Dubai Free Zone

To establish a company in the Dubai Free Zone, investors must submit a set of basic documents and papers. Here is a list of the required papers:

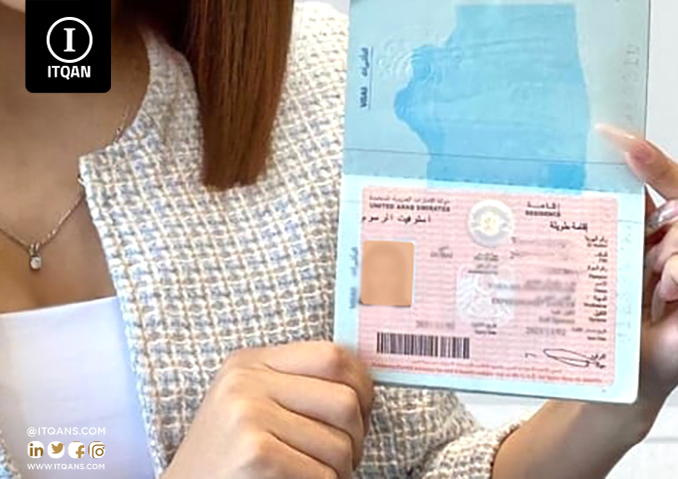

- Passport: Copy of passport for each shareholder and director.

- Personal Photographs: Recent personal photographs of both shareholders and directors.

- Incorporation Application Form: A form containing details of the proposed company and business activity.

- Business Plan: A document that describes the nature of the business, goals, and future plans.

- Lease Contract: A document proving the lease of an office or commercial space within the free zone.

- Identity Documents: Copy of National ID or Residence Card (if shareholders are UAE residents).

- Trade Name: A list of proposed trade names for approval, provided that the names are not already in use.

- Power of Attorney : If there is an agent acting on behalf of the investor, an official power of attorney must be submitted.

- Additional Documents : Depending on the type of business, some activities may require additional documents such as professional certificates or a previous Dubai trade license .

Requirements vary slightly from one free zone to another, so it is always best to check the specific requirements of the free zone in which you wish to establish your company.

Conditions for establishing a company in the Dubai Free Zone

To establish a company in the Dubai Free Zone, there are a set of conditions and requirements that investors must adhere to. Here are the basic conditions:

- Determine the business activity: The investor must determine the type of activity he wishes to engage in, as some business activities require special licenses.

- Compliance with legal requirements: The company name and activity must comply with the laws and regulations in force in the free zone, and the name must not be similar to the names of existing companies.

- Required documents: Submit a set of necessary documents, such as passports, personal photos, an establishment application form, and an office rental contract.

- Minimum Capital: Some businesses may require a certain minimum capital, so check the specific requirements of each free zone.

- Registration in the Commercial Register: Investors must register the company in the commercial register of the relevant free zone.

- Appointment of a director for the company: A director must be appointed for the company, and this director may be one of the shareholders or another person from outside the company.

- Opening a bank account: The investor must open a bank account in the name of the company with a local bank.

- Tax Registration: You must comply with any local tax requirements, although companies in free zones often enjoy tax exemptions.

- Compliance with labor laws: If the company is going to employ employees, it must comply with local labor laws and register with the relevant authority.

It is important to review the specific requirements of the free zone in which you wish to establish your company, as requirements may vary slightly from one zone to another.

In conclusion, setting up a company in a Dubai free zone is a great investment option that offers many opportunities and benefits. With a flexible business environment, attractive tax exemptions, and 100% foreign ownership, investors can easily and quickly grow their businesses. The advanced infrastructure and government support make Dubai one of the best business destinations in the world. So, if you are thinking of entering the business world, Dubai free zones offer you the perfect opportunity to realize your business ambitions and achieve success in a dynamic and diverse market.

Frequently asked questions about establishing a company in the Dubai Free Zone

What are the free zones in Dubai?

Dubai free zones are designated economic zones that allow companies to set up with special facilities and incentives such as tax exemptions and full foreign ownership.

What types of companies can be established in free zones?

Several types of companies can be established, including limited liability companies, branches, joint stock companies, and sole proprietorships.

How long does it take to set up a company in the free zone?

The company establishment period usually ranges from 3 to 7 working days, depending on the availability of the required documents and procedures.